Thing 1: carbon pricing is a good idea that conservatives invented and they should proudly own it. Instead, we’re in this surreal hellscape where they’ve disavowed their idea, labelled it as the “Liberal carbon tax” and are campaigning hard against it.

To be clear, it was under the federal Liberal Party that the government passed the carbon tax legislation that attached a price to carbon consumption which applied nationwide – except where a province had their own plans which substantially meets the same goals.

BC had their own, Alberta (under the NDP) had their own, Quebec, Ontario (under their previous Liberal gov’t) had their own – of the large provinces.

Ousting the provincial NDP gov’t in Alberta and subsequent defeat of the Ontario Liberals brought conservative regimes to power in both provinces. For reasons unknown to logic, they both repealed their own carbon pricing regime – with triggered the federal one to be imposed.

They handed control over this file TO the Federal Liberals and Justin Trudeau…for which they attack him for now.

Now, I get the electoral politics here; it is politically expedient to align against a program enacted by your political opponent. There is a short term benefit to that in the context of polling to be sure. But the longer term side effect is ones credibility.

But the elephant in the room is the fact that carbon pricing is intended to act as a consumption tax (the form of tax that conservatives generally support), that is supposed to be revenue neutral. Carbon pricing dings the consumption, rewards the reductions we make in our carbon footprint. Any excess therein is generally redistributed in forms of tax relief and various rebates/credits to offset the financial burden of the various carbon taxes at the lowest income scales.

That was the idea behind carbon pricing. Philosophically, it’s a good idea and yes, the devil is in the details.

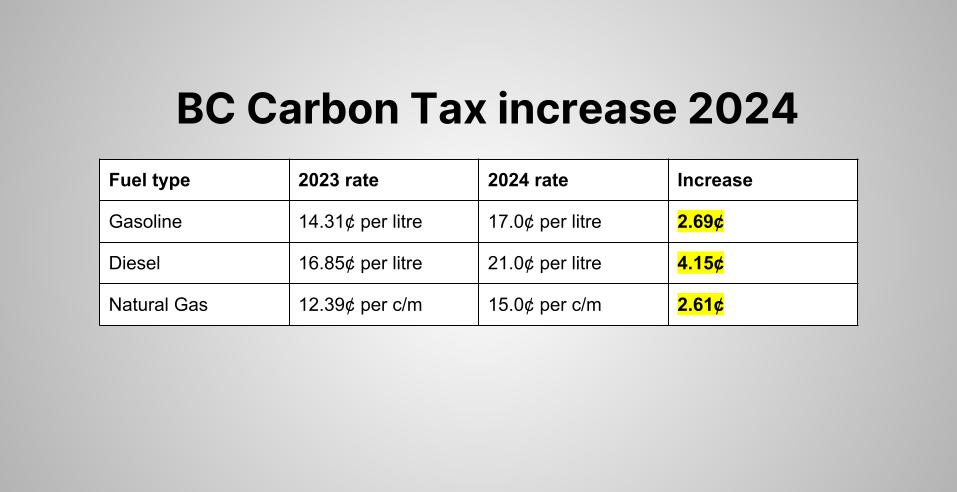

The crux of the current debate is the scheduled increase on April 1, 2024 of the per-tonne carbon rate. The detractors calculate that as a 23% increase. Sure, we’ll take that argument at face value.

But this is no ordinary tax, and the reasons for it aren’t specifically for basic revenue generation reasons.

Thing 2: why we have carbon pricing.

Look around you. The effects of climate change are only disputed by small cabal who would argue that the world is also only 6,000 years old.

We have once-in-a-lifetime climate events every year now. BC has had several record wildfire seasons in the last decade at the cost of billions of dollars each – and that’s just the cost of fighting the fire. The other costs are the post-fire repairs, mitigation, compensation, and effects on the economy where the fires damage timber supply to our forestry sector; or other important agriculture operations. Same problem for the atmospheric rivers – which entered BC’s weather lexicon in the last few years as catastrophic rains and flooding diplace towns, farms, disrupt transportation links, etc.

Private and public insurance rates increase as a result of the redemption of insurance policies made necessary by climate triggered damages. The effect the bottom line for business and families are sure to be felt with higher premiums, or taxpayer supported bailouts when insurance companies fail to deliver on their policies.

These are the costs of climate change. There’s no hope that this cost decreases so long as we don’t take this seriously.

Thing 3: Anti-tax propaganda and hypocrisy of the far right.

To hear the rhetoric of the opponents, the carbon tax rates are to be increasing by almost 20¢ per litre for regular gasoline. That’d be huge – if it was true.

Spoiler: its a lie.

2.69¢ per litre is a far cry from the 18¢ being pushed by conservative propagandists.

To be sure, few people will willingly embrace any tax increase, though most people accept that taxes are necessary. But if we’re to debate tax policy, let’s start out from a position of honesty. Conservatives are absolutely not being honest. But that’s their trademark: lie about something, then campaign about the thing that isn’t true…make it about big government hurting the little guy.

The problem is that government has a requirement under our constitution to do what it can to protect society; and climate change – the effects therein, are a real – existential threat to Canada and the world around us. By having conservatives undermine the threat of climate change, they’re putting society at grave harm.

The harm isn’t specific to flooding in leftwing BC coastal areas from atmospheric rivers and rising sea levels, the harm is also the droughts affecting interior, northern and prairie agricultural sectors. These are small towns and rural areas that the conservatives call their base of support. Watch and see how absent these politicians become once their farming towns are decimated from a raging wildfire made possible by soils and plants dried out from a lack of snow and spring rains.

Thing 4: the carbon tax is a consumption tax, something that conservatives generally like.

Think of the GST. I remember that chaos of an introduction in 1989/90 when the then PC Party government under Brian Mulroney replaced the Manufacturers Sales tax with the GST.

The revenue haul from that tax is substantial. Ottawa collects a gross $48 billion annually from the GST. The GST credit, designed for low income adults in Canada costs up to $5 billion annually. That’s a staggering profit. All leftover revenue goes to the general funds of the nation and finance whatever is deemed appropriate in the annual budget.

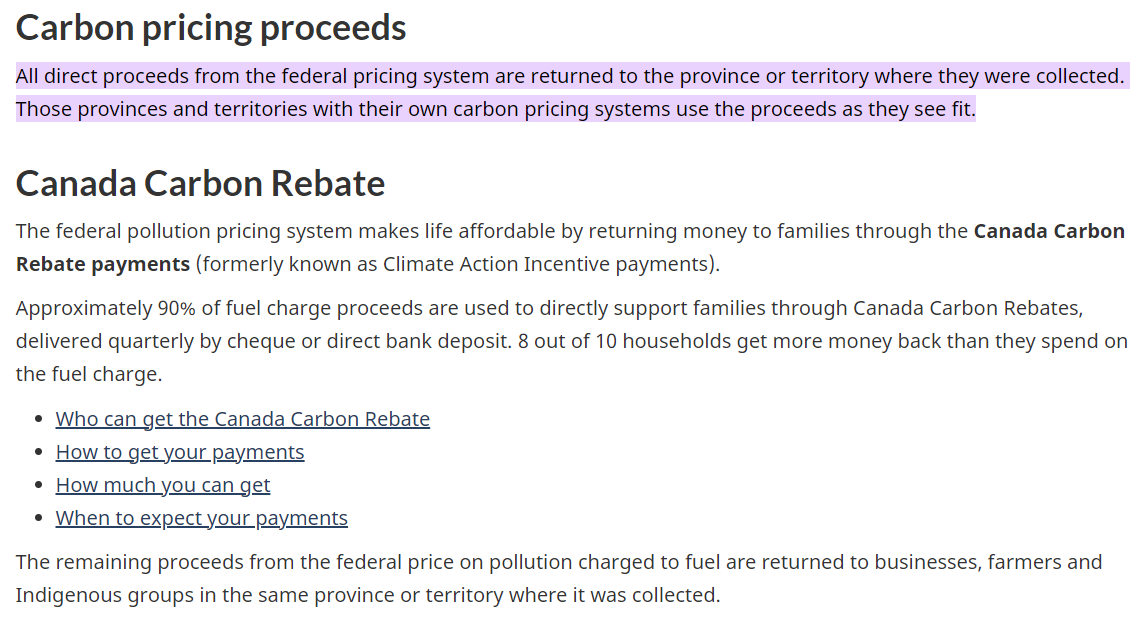

The Carbon Tax is different. It’s supposed to be revenue neutral, and it largely is; but its purpose driven. In Canada, where the federal carbon tax is collected from; the proceeds are turned around and remitted back to the provinces where they originated.

In BC, where the carbon tax revenue allocations are spelled out; well over half is returned in a ‘climate change’ credit, and the remainder is split between an electric vehicle rebate program (on the purchase of a new zero emission vehicle), a BC Hydro rebate to install heat pumps, and funds to assist in carbon friendly retrofits. In both cases, federal and provincial, while not exactly as revenue neutral – they come awfully close…and a lot closer than the GST which is the original consumption tax in Canada.

Summary

Conservatives are trying to position the carbon tax issue merely as a political one; where they’re seen as the good guys trying to hold back the ever-oppressive federal government from taxing citizens into oblivion. It is that over simplification that gets played over and over and over in the media and we’ve stopped talking about what is really at stake.

The controversy of carbon pricing is that it shouldn’t be controversial. The goals and means are clearly stated, and the evidence that its working is also just as compelling.

Sure, nobody likes it when things cost more, but that is the taxation model of carbon pricing; increase the price through the tax, decrease demand. The “23%” increase looming this April 1 equates to 2.69 cents/litre in BC which has so many folks upset, but nobody says anything when big oil jacks the price up by 30 or 45cents over the span of a couple weeks for no reason.

We’re set to judge our political leaders in the coming months over policies and performance based on how we feel in the moment. But we are going to be judged by our children and grandchildren by our failure to act when we fully knew better.

It’s time to stop being influenced by the here-and-now politics, and be swayed by the do-the-right-thing planning for the future.

My2bits